In the ever-evolving world of financial technology, businesses are constantly seeking innovative ways to engage with their clients. One such innovation is the use of WhatsApp Business API by stock broker companies to provide real-time updates and personalized communication. This article explores how these firms leverage WhatsApp to enhance customer interaction, improve service efficiency, and stay ahead in a competitive market.

The Rise of WhatsApp in Financial Services

WhatsApp, launched in 2009, has grown from a simple messaging app into a global communication powerhouse. With over 2 billion users worldwide, it’s no surprise that businesses, including stock brokers, have turned to this platform for its speed, reliability, and user-friendly interface. For stock brokers, WhatsApp offers a unique advantage: the ability to send instant alerts, portfolio updates, and market insights directly to clients’ mobile devices.

This shift is not just about convenience; it’s about meeting customers where they are. In an age where attention spans are short and information is abundant, WhatsApp provides a direct line of communication that is both efficient and effective. Unlike traditional methods like email or phone calls, WhatsApp messages are more likely to be read and acted upon promptly.

Key Uses of WhatsApp Business API in Stock Broking

Stock broker companies have found numerous applications for the WhatsApp Business API, each tailored to meet the specific needs of their clients. Here are some of the most common and impactful uses:

1. Real-Time Portfolio Updates

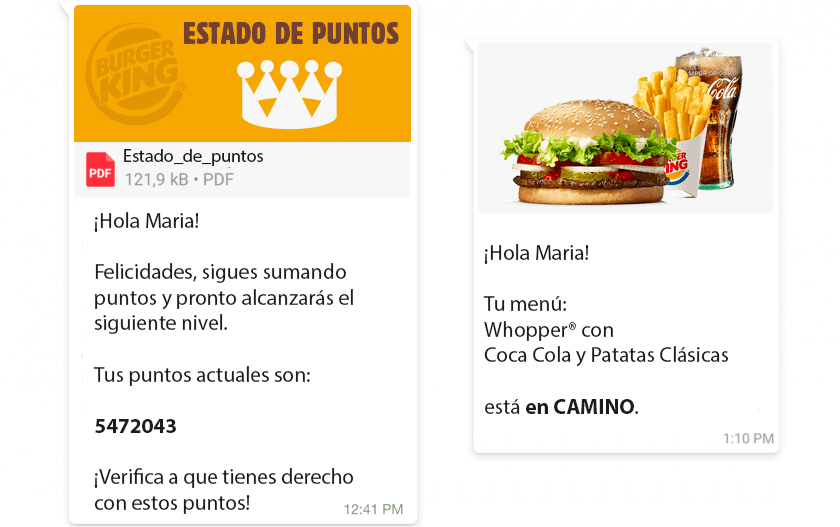

One of the most significant benefits of using WhatsApp Business API is the ability to provide real-time updates on clients’ portfolios. When a stock’s price fluctuates or a trade is executed, brokers can instantly notify their clients through WhatsApp. This ensures that investors are always informed and can make timely decisions.

2. Automated Messaging

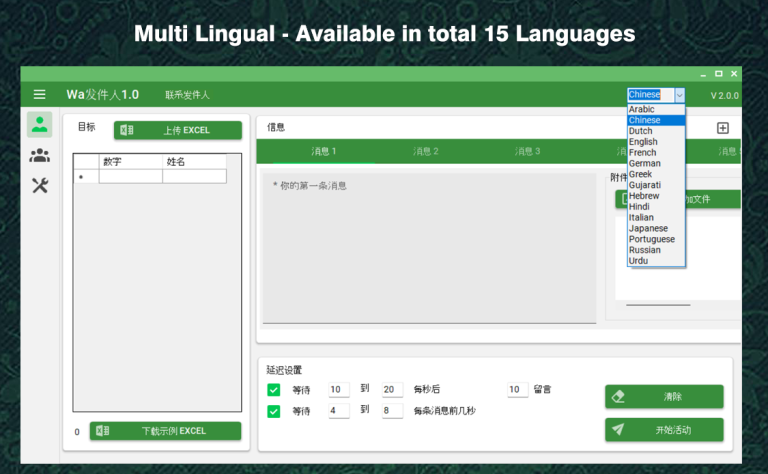

Automated messaging is another powerful feature of the WhatsApp Business API. Brokers can set up triggers to send notifications based on predefined conditions, such as when a stock reaches a certain price or when a client makes a trade. This automation saves time and ensures that clients receive timely updates without manual intervention.

3. Personalized Communication

WhatsApp allows for highly personalized communication, which is crucial in building trust and loyalty with clients. Brokers can tailor messages to individual investment goals, preferences, and risk tolerance levels. This level of customization helps clients feel valued and supported, strengthening the relationship between the broker and the investor.

4. One-on-One Customer Support

The WhatsApp Business API also enables one-on-one customer support. Clients can reach out to their brokers directly through WhatsApp, and brokers can respond in real-time. This immediate access to support enhances the overall customer experience and fosters a sense of reliability and transparency.

5. Stock Recommendations

Brokers can use WhatsApp to share stock recommendations with their clients. By analyzing market trends and individual client profiles, brokers can suggest stocks that align with their investment goals. These recommendations are often accompanied by detailed analysis, helping clients make informed decisions.

6. Real-Time News Updates

Market conditions can change rapidly, and staying updated is essential for investors. WhatsApp allows brokers to send real-time news updates, regulatory changes, and company announcements directly to their clients. This ensures that investors are always aware of the latest developments that could impact their portfolios.

Benefits of Using WhatsApp Business API

The adoption of WhatsApp Business API by stock broker companies comes with a host of benefits, including:

- Real-Time Updates: Clients receive instant notifications about their portfolios and market changes.

- Personalized Communication: Messages are tailored to individual client needs, enhancing engagement.

- Enhanced Customer Support: Real-time interactions build trust and improve the customer experience.

- Automated Messaging: Reduces manual workload and ensures consistent communication.

- Cost-Effective: Compared to traditional communication methods, WhatsApp is a cost-effective solution for businesses.

Case Studies: Success Stories

Several leading stock broker companies have successfully integrated WhatsApp Business API into their operations. For example:

- Zerodha, an Indian stock broker, uses WhatsApp to send trading alerts and portfolio updates to its clients.

- HDFC Securities leverages WhatsApp to provide account-related information and trade alerts.

- Fidelity Investments and Charles Schwab, both U.S.-based firms, use WhatsApp to deliver real-time market updates and investment insights.

These examples demonstrate the versatility and effectiveness of WhatsApp in the financial sector.

Challenges and Considerations

While the benefits of using WhatsApp Business API are clear, there are also challenges and considerations that stock brokers must address. These include ensuring compliance with data protection regulations, maintaining message security, and avoiding spamming clients with excessive notifications.

Additionally, brokers must strike a balance between providing valuable information and respecting client preferences. Overloading clients with too many messages can lead to disengagement and even unsubscribes.

Conclusion

The integration of WhatsApp Business API into stock broking operations represents a significant step forward in the digital transformation of financial services. By leveraging this powerful tool, brokers can enhance customer engagement, improve service efficiency, and stay competitive in a rapidly evolving market. As more companies adopt this technology, we can expect to see continued innovation and improved experiences for investors around the world.